The temporary 50% reduction in minimum annual payment amounts for superannuation pensions and annuities has been extended by a further year to 30 June 2023. This temporary measure was first introduced by the government in response to the COVID-19 pandemic causing significant losses in financial markets, which negatively impacted account balances of super and pension/annuity of many retirees.

The reduction in the minimum pension drawdowns applied for the 2019-20, 2020-21 and 2021-22 income years was due to end on 30 June 2022. However, as a part of the Budget, the government announced and subsequently introduced SIS Regulations to extend this temporary reduction to the 2022-23 income year. According to the government, given ongoing volatility, the extension of this measure to 2022-23 will ensure that retirees will not be forced to sell assets in order to satisfy the minimum drawdown requirements.

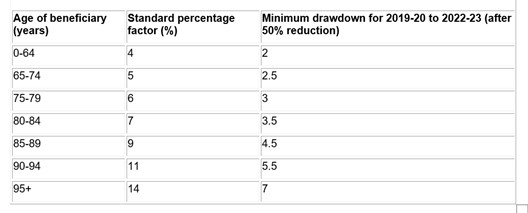

In general, minimum payments are determined by age of the beneficiary and the value of the account balance as at 1 July each year.

For market linked income streams, the minimum payment amount from 1 July 2022 is a little more complicated. In most cases, it must be not less than 45% (and not greater than 110%) of the amount determined under the standard formula in the SIS Regulations.

Minimum annual payments are usually calculated by the superannuation and/or annuity providers at 1 July each year based on the account balance of the member or annuitant. For example, Jerry is 67 years old and decides to retire. On 1 July 2022, Jerry’s account based pension balance was $600,000. The minimum drawdown rate according to Jerry’s age is 2.5% and Jerry’s required annual minimum pension payment for the 2022-23 income year is $15,000 ($600,000 x 2.5%).

While the minimum annual payments are mandated, there are no maximum annual payments, except for transition to retirement pensions which have a maximum annual payment limit of 10% of the account balance at the start of each financial year. This means that retirees do not have to adhere to the 50% reduction in the minimum annual pension payments and can continue to draw a pension at the full minimum drawdown rate or above.

In the example of Jerry, if he has no other income, he may find that $15,000 per year is not enough to fund his lifestyle, in which case, he can choose to drawdown at the full rate of 5% which will give him $30,000 per year. However, it should be noted that drawing more than the minimum rate in the form of a pension payment may have unintended effects for the pension transfer balance cap, so professional advice should be sought before changing minimum annual payments.